Coronavirus likely to hit multipurpose shipping hard too

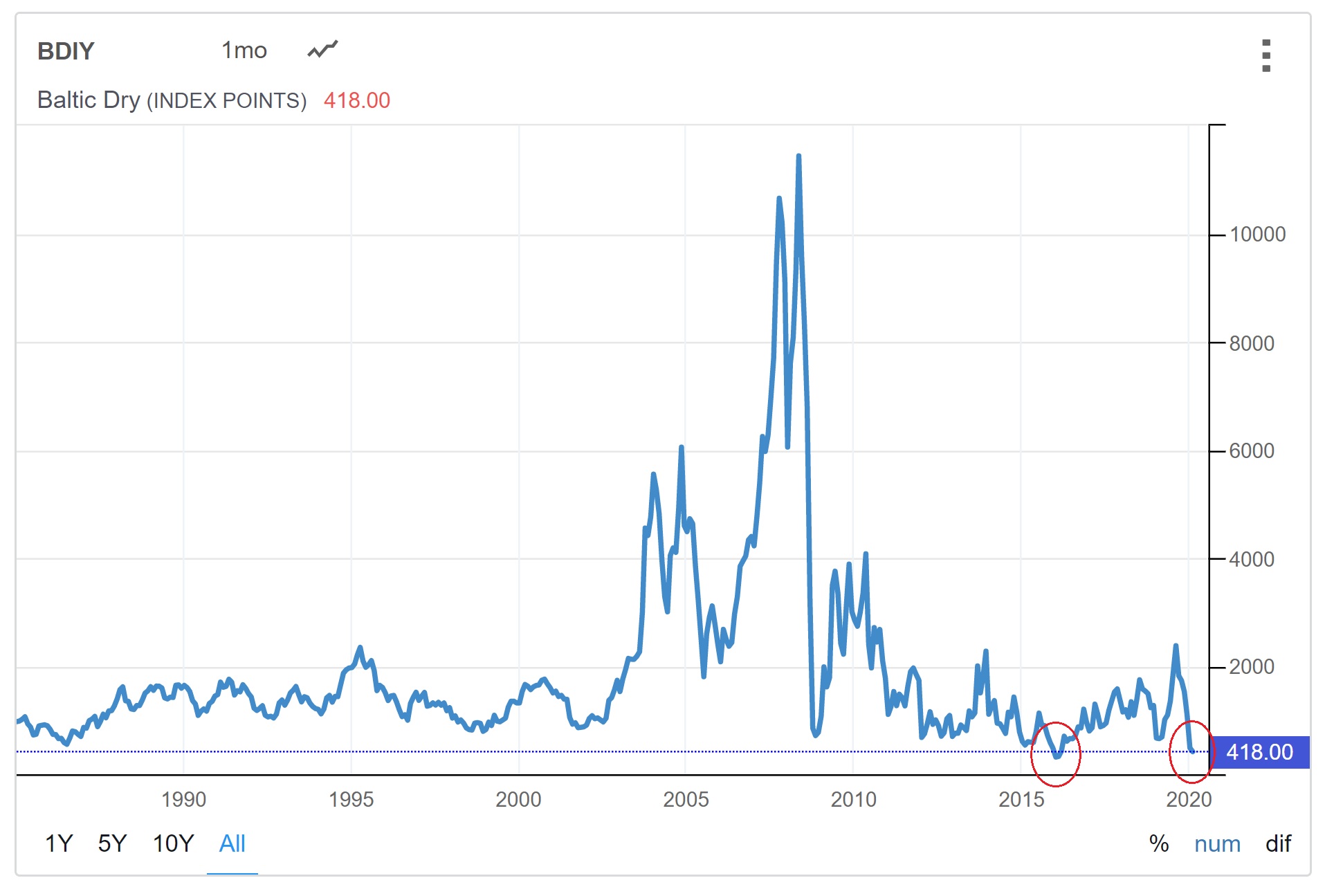

Amidst the chaos and uncertainty, analysts find it difficult to estimate the exact impact of the coronavirus on the multipurpose and heavy-lift shipping industry but certain is that key markets and competing sectors are heavily affected. Oil demand growth is estimated to fall by 25% while the Baltic Dry Index has reached its second-lowest dip in the index’s history.

“There is no way of knowing the full impact of the coronavirus without having a view on its longevity”, Drewry’s senior analyst for Multipurpose & Breakbulk Shipping, Susan Oatway, tells PCJ. “In the worst case, the disruption to the supply chain will be huge, particularly for those sectors with no viable alternative sources such as electronics, household appliances and auto parts. If it is short-lived the pent up demand should be strong and China, in our opinion, will do its best to prop up growth via fiscal stimulus. In the meantime, as industrial production slows carriers are having to scale back capacity sharply.”

There have already been reports that project cargo demand for products manufactured in China is slowing.

“For the MPV/HL sector, the effect on the container and bulk carriers will have a significant effect due to the increased competition for commodity demand. Specifically, there have already been reports that project cargo demand for products manufactured in China is slowing and already having an effect on the market.”

Shipping companies so far seem to take a wait-and-see approach. “The coronavirus is definitely a joker in today’s market. We have made contingency plans and we’re trying to reposition some of our vessels, but China is a major market, so to some extent, we’ll also just have to see how it develops”, managing director Lars Bonnesen of United Heavy Lift told PCJ.

Competing sectors

The container, dry bulk and tanker shipping markets have already been impacted severely by the virus outbreak.

In the container sector, analyst Sea Intelligence Consulting warns of revenue losses of up to USD 350 million a week as carriers have cancelled a large number of sailings on both the Trans-Pacific and Asia-Europe trade lanes. Based on interviews Drewry held with Chinese port operators, container throughput already dropped by 20 to 40% in from 20 January to 10 February 2020. Drewry does expect the carriers to run extra sailings to cope with the upwards swings in volumes, once the pipelines reopen.

Meanwhile, the Baltic Dry Index keeps declining and currently stands at just 418 points, the second-lowest point since the inception of the index 1985. Only in February 2016, when the shipping industry was in a general state of crisis, the Baltic Dry Index dropped even further to 290 index points. In comparison, at the beginning of December, the index still stood around 1,500 points and on January 2nd at 976 points.

It is important to note that the decrease in volumes and the index are not solely the result of the coronavirus. IMO 2020 and traditional lower activity in the first quarter play a role as well. However, the coronavirus outbreak accelerates the decrease in volumes and activity and adds significant uncertainty. Drewry deems it likely that many factories won’t resume full production for another 3 to 4 weeks.

Article continues below image.

Oil demand growth slashed

Oil demand is also heavily impacted by the outbreak. Norwegian analyst firm Rystad Energy has lowered its 2020 forecast for oil demand growth by 25% to 820,000 bpd. In the previous forecast, published in December, before the coronavirus outbreak, demand growth stood at 1.1 million barrels per day (bpd). Rystad also warns that the forecast could be lowered even further, with the worst-case scenario slashing growth to as low as 650,000 bpd year-on-year.

“Our current assessment implies that the impact of coronavirus will persist throughout all of February and March and will then gradually subside towards June 2020. We hence expect travel restrictions and extended holidays in China to significantly impair demand in 1Q20 and partially in 2Q20. Demand is forecast to start recovering in April and May,” said Bjornar Tonhaugen, Rystad Energy’s Senior Vice President, Head of Oil Markets.

EPC contractors

Although oilfield service providers and EPC-contractors are not impacted directly by the lower oil demand growth, Rystad’s senior analyst for the Energy Markets, Artyom Tchen, warns there could be some effect as oil producers will be adjusting the oil supply to balance oil prices.

“At the moment, the coronavirus is a short term impact that is expected to last no more than two quarters. However, oil producers will likely reduce their oil output. OPEC is currently talking about a reduction of 600,000 bpd which could take effect as early as mid-February. Depending on the duration of those additional cuts, oilfield services providers could be affected as well”, Tchen says.

Crew movement

Next to decreased cargo volumes and increased competition, multipurpose shipping companies are also presented with challenges in their sailing schedules and the movement of crew. “Whilst several countries no longer allow (Chinese) crews to disembark, the Australian Government has gone even further, with a ban on merchant ship entering its ports within fourteen days of leaving China”, says analyst Frans Waals of Dynamar.

Together we know more. If you have any information, remarks or insights that can add to this story, please contact us at [email protected].

morenews

Project Cargo Summit 2024 programme takes shape

Excitement is building for the Project Cargo Summit 2024 in Bilbao, Spain! The dates are locked in (September 17th and 18th), the speaker list is filling up fast, and preparations are underway to make the “Project Cargo Summit 2024: Mega Cargo, Mega Solutions” an unforgettable event.

Project Cargo Summit 2024 registrations open

The time has come, we have opened registrations for this year’s edition of the Project Cargo Summit. As it was previously unveiled, the Port of Bilbao will be our host on September 17 and 18. There have been some changes since the announcement.

Project Cargo Summit goes to Bilbao

Following the successful outing in Bremen in 2023, ProMedia and its Project Cargo Summit team have turned their sights to a new adventure and have partnered with the Port of Bilbao. So for the 2024 edition of the Project Cargo Summit, project cargo, breakbulk and heavy lift industry specialists will gather in Bilbao for two… Read more ›