US offshore wind investments could overtake offshore oil and gas by 2025

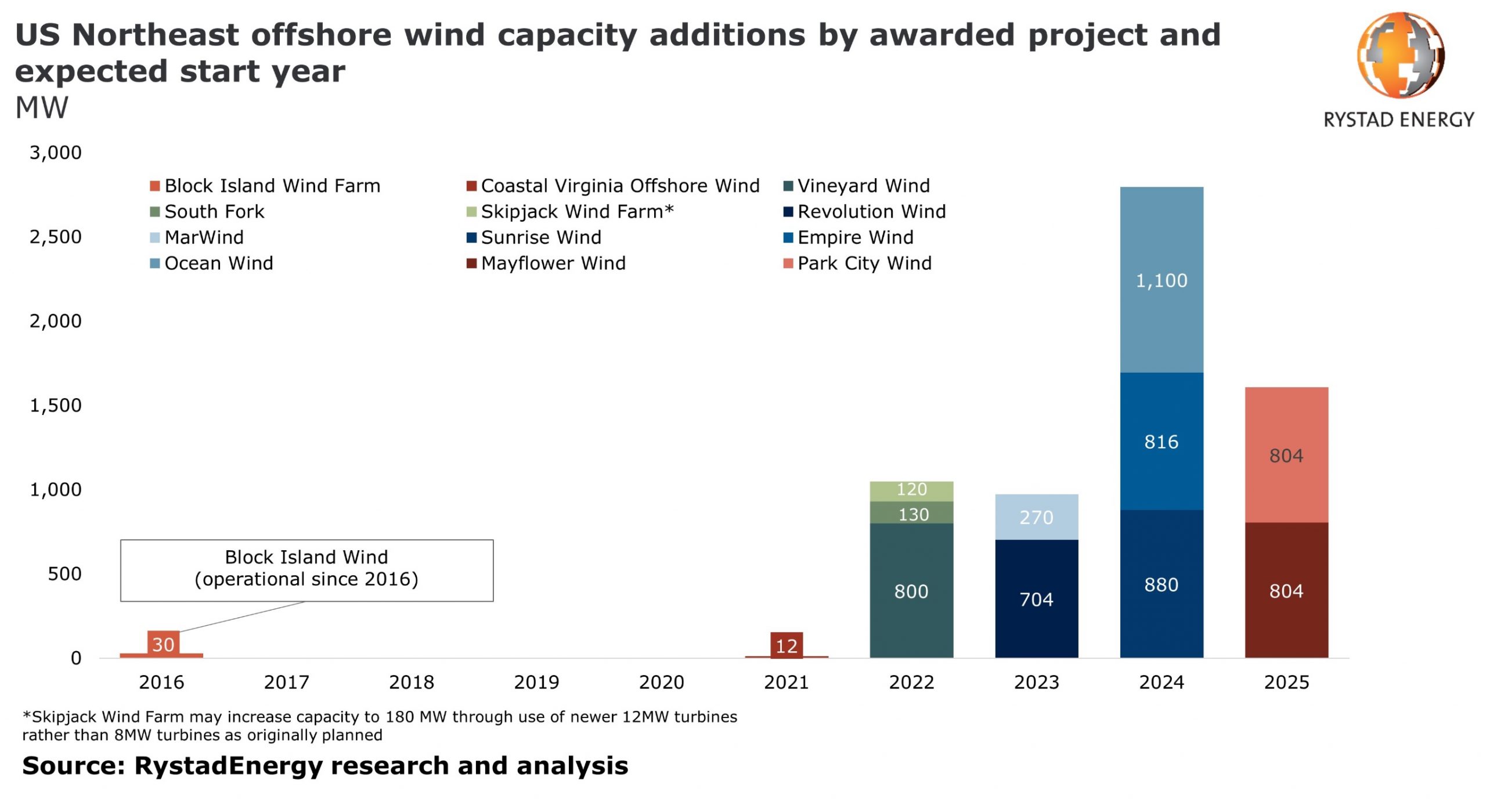

Installed offshore wind capacity in US waters could reach 20GW by 2030 and annual investments in the sector could surpass USD 15 billion by the mid-2020s. That would mean capital expenditure in US offshore wind will likely exceed those in US offshore oil and gas within the next five years, writes Rystad Energy.

“There are currently 6 GW of offshore wind projects in the US that have been sanctioned for development, requiring collective investments of more than USD 20 billion over the next five years”, says Tim Bjerkelund, Head of Consulting New York at Rystad Energy. “Assuming continued support from the regulators, many more projects will be sanctioned in the coming years and we expect to see yearly investments in the sector exceed $15 billion by the middle of the decade. That would certainly signal an energy revolution and offshore suppliers should take note.”

By comparison, Rystad Energy expects annual expenditure on US offshore oil and gas projects to average USD 14.8 billion between 2020 and 2025.

Northeast US

The majority of the offshore wind projects are located in the Northeast of the United States. These states are facing the same problem as Northwest European countries were; renewable energy can reduce the dependency of energy imports, but the region lacks available land to accommodate wind and solar farms.

According to Bjerkelund, the states have “wisely” picked up the same playbook as European countries by moving the wind farms offshore and benefit from the technological developments and cost efficiencies introduced in the North Sea. The costs for major projects like Vineyard Wind are expected to be close to the levels of European projects. This bodes well for an industry that is still in its infancy, notes Rystad Energy.

According to the Energy Information Administration (EIA), the potential for offshore wind in the US is 7200 Terawatt hour (TWh). If all of this were to be realized, it would equal hundreds of projects similar to the ones already sanctioned, with each requiring investments of around USD 3 billion on average.

“The emergence of offshore wind as an industry in the US is truly exciting. The energy transition is taking place now, not through small test projects, but through utility-scale projects that each require billions of dollars in investment,” Bjerkelund concludes.

morenews

Project Cargo Summit 2024 registrations open

The time has come, we have opened registrations for this year’s edition of the Project Cargo Summit. As it was previously unveiled, the Port of Bilbao will be our host on September 17 and 18. There have been some changes since the announcement.

Project Cargo Summit 2024 programme takes shape

Excitement is building for the Project Cargo Summit 2024 in Bilbao, Spain! The dates are locked in (September 17th and 18th), the speaker list is filling up fast, and preparations are underway to make the “Project Cargo Summit 2024: Mega Cargo, Mega Solutions” an unforgettable event.

Project Cargo Summit goes to Bilbao

Following the successful outing in Bremen in 2023, ProMedia and its Project Cargo Summit team have turned their sights to a new adventure and have partnered with the Port of Bilbao. So for the 2024 edition of the Project Cargo Summit, project cargo, breakbulk and heavy lift industry specialists will gather in Bilbao for two… Read more ›